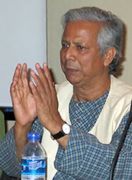

Bangladeshi Banker to the Poor, Muhammad Yunus, and his Grameen Bank are winners of the 2006 Nobel Peace Prize for their efforts to help lift millions of women and men from poverty, nurturing their small business dreams with tiny loans as small as $20 each.

Over the last 30 years, Yunus’ bank has issued more than five billion dollars into the hands of 6 million borrowers yielding phenomenal results. Called micro-financing, low-interest loans are offered that require no collateral, but collect repayment over a period of years after placing people in honor system support groups. Given that opportunity, even the poorest of the poor can — and will — work to create their own well-being and raise their families and communities out of poverty.

Over the last 30 years, Yunus’ bank has issued more than five billion dollars into the hands of 6 million borrowers yielding phenomenal results. Called micro-financing, low-interest loans are offered that require no collateral, but collect repayment over a period of years after placing people in honor system support groups. Given that opportunity, even the poorest of the poor can — and will — work to create their own well-being and raise their families and communities out of poverty.

“Charity is not the answer to poverty,” Yunus said. “It only helps poverty to continue. It creates dependency and takes away the individual’s initiative to break through the wall of poverty.”

During a famine in Bangladesh, Yunus discovered that very small loans could make a significant difference in a poor person’s ability to thrive. His first loan consisted of $27 from his own pocket, which he lent to women who made bamboo furniture in a rural village near the university where he worked. The woman used the money to buy bamboo, lifting her craftsmanship to a profitable level, breaking the bonds of not only her poverty, but her workers as well. The loan was repaid in full.

30 years and more than $5.7 billion in loans later, Yunus is just getting started helping the poor. His long-term vision is no less than the elimination of poverty from the world. He told reporters he would use part of his share of the $1.4 million award money to create a company that would make low-cost, high-nutrition food for the poor. The rest of his share would go toward setting up an eye hospital for the poor in Bangladesh.

Muhammad Yunus was born in Bangladesh in 1940. He studied Economics at Dhaka University and obtained his Ph.D. at Vanderbilt University in the US when he was 29 years old. Three years later he moved back to his hometown in Bangladesh, where he joined Chittagong University as a professor of economics. In 1976, Yunus founded the Grameen Bank to make loans to poor Bangladeshis.

Loans to poor people without any financial security might have seemed an impossible idea. But to ensure repayment, the bank relies on a system of solidarity groups. Small informal groups of villagers apply together for loans and the groups’ members act as co-guarantors of repayment and support one another’s efforts at economic self-advancement. Because of this community solidarity, the borrowers’ default rate has remained less at than 2 per cent.

The success of the Grameen model has inspired similar efforts throughout the developing world and even in industrialized nations like the United States, where the PLAN project is helping people start small businesses in Dallas, Texas.

The Grameen model of micro financing has been emulated in 23 countries and many of the projects have maintained the emphasis toward lending specifically to women. More than 96% of Grameen loans have gone to women, who suffer disproportionately from poverty and who are more likely than men to devote their earnings to serving the needs of the entire family.

Muhammad Yunus, the author of Banker to the Poor: Micro-Lending and the Battle Against World Poverty, is the first Bangladeshi to win the Nobel Peace Prize.

FURTHER READING

Times Online tells the story of one Grameen borrower who, with her $50.00 loan, bought a cow. Now she owns a restaurant and three shops and her family no longer goes to sleep hungry

An NBC News story, Richly Deserved Prize for Banker to the Poor, has some great storytelling describing Yunus’ work.