Whatever you think about the financial rescue package the US Congress and president passed into law last week, it also includes incentives and benefits for consumers and businesses helping to expand energy conservation and renewable energy in America.

Whatever you think about the financial rescue package the US Congress and president passed into law last week, it also includes incentives and benefits for consumers and businesses helping to expand energy conservation and renewable energy in America.

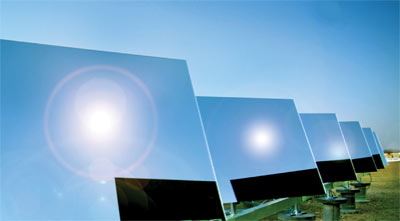

The bill provides a $3,000 tax credit toward the purchase of a fuel-efficient, plug-in hybrid vehicle. Additional tax credits boost industries pushing alternative fuels, geothermal and wind, but the big winner by far was solar.

The 30% solar investment tax credit has been extended to 2016 giving solar startups, utilities and their backers incentives to build large-scale power plants and other projects. Homeowners can get a 30% tax credit on solar panels installed next year — and may, in some states, receive rebate incentives from their state, like in California and Colorado.

The bill also provides a $3,000 tax credit for those who purchase a fuel-efficient, plug-in hybrid vehicle.

There are also incentives for the production of homegrown renewable fuels, such as biodiesel and renewable diesel, and for the installation of E-85 pumps for consumers to fill up flex-fuel vehicles.