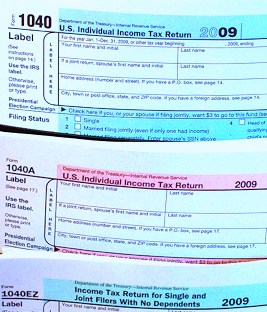

Since January 2009, President Obama and Congress has passed or extended 17 small business tax cuts and credits, including the exclusion of up to 75% capital gains on key small business investments and new tax credits for hiring Americans who had been out of work for at least two months.

Since January 2009, President Obama and Congress has passed or extended 17 small business tax cuts and credits, including the exclusion of up to 75% capital gains on key small business investments and new tax credits for hiring Americans who had been out of work for at least two months.

The Small Business Jobs Act, signed in September of 2010, had eight tax cuts and credits in it. These included raising the small business expensing limit to $500,000, the highest ever; simplifying the rules for claiming a deduction for business cell phone use; creating a new deduction for health care costs for the self-employed; allowing greater deductions for start-up expenses for entrepreneurs, and eliminating taxes on all capital gains from key small business investments.

In December of 2010, President Obama also signed a tax bill that went one step further and allowed all businesses — large and small — to expense 100 percent of their new investments until the end of 2011. It also extended the elimination of capital gains taxes for small business investments through the end of 2012 — and the President’s budget has proposed to make that tax cut permanent.

Here’s the list of the 17 new small business tax cuts since 2009:

- A New Small Business Health Care Tax Credit

- A New Tax Credit for Hiring Unemployed Workers

- Bonus Depreciation Tax Incentives to Support New Investment

- 75% Exclusion of Small Business Capital Gains

- Expansion of Limits on Small Business Expensing

- Five-Year Carryback of Net Operating Losses

- Reduction of the Built-In Gains Holding Period for Small Businesses from 10 to 7 Years to Allow Small Business Greater Flexibility in Their Investments

- Temporary Small Business Estimated Tax Payment Relief to Allow Small Businesses to Keep Needed Cash on Hand

- Zero Capital Gains Taxes on Key Investments in Small Businesses

- The Highest Small Business Expensing Limit Ever– Up to $500,000

- An Extension of 50% Bonus Depreciation

- A New Deduction for Health Care Expenses for the Self-Employed

- Tax Relief and Simplification for Cell Phone Deductions

- An Increase in The Deduction for Entrepreneurs’ Start-Up Expenses

- A Five-Year Carryback Of General Business Credits

- Limitations on Penalties for Errors in Tax Reporting That Disproportionately Affect Small Business

- 100 Percent Expensing

Find information on the IRS website regarding eligibility and details on cuts contained in the health care bill, here and the Hire Act, here. Get some more information at the Small Business Administration, here.